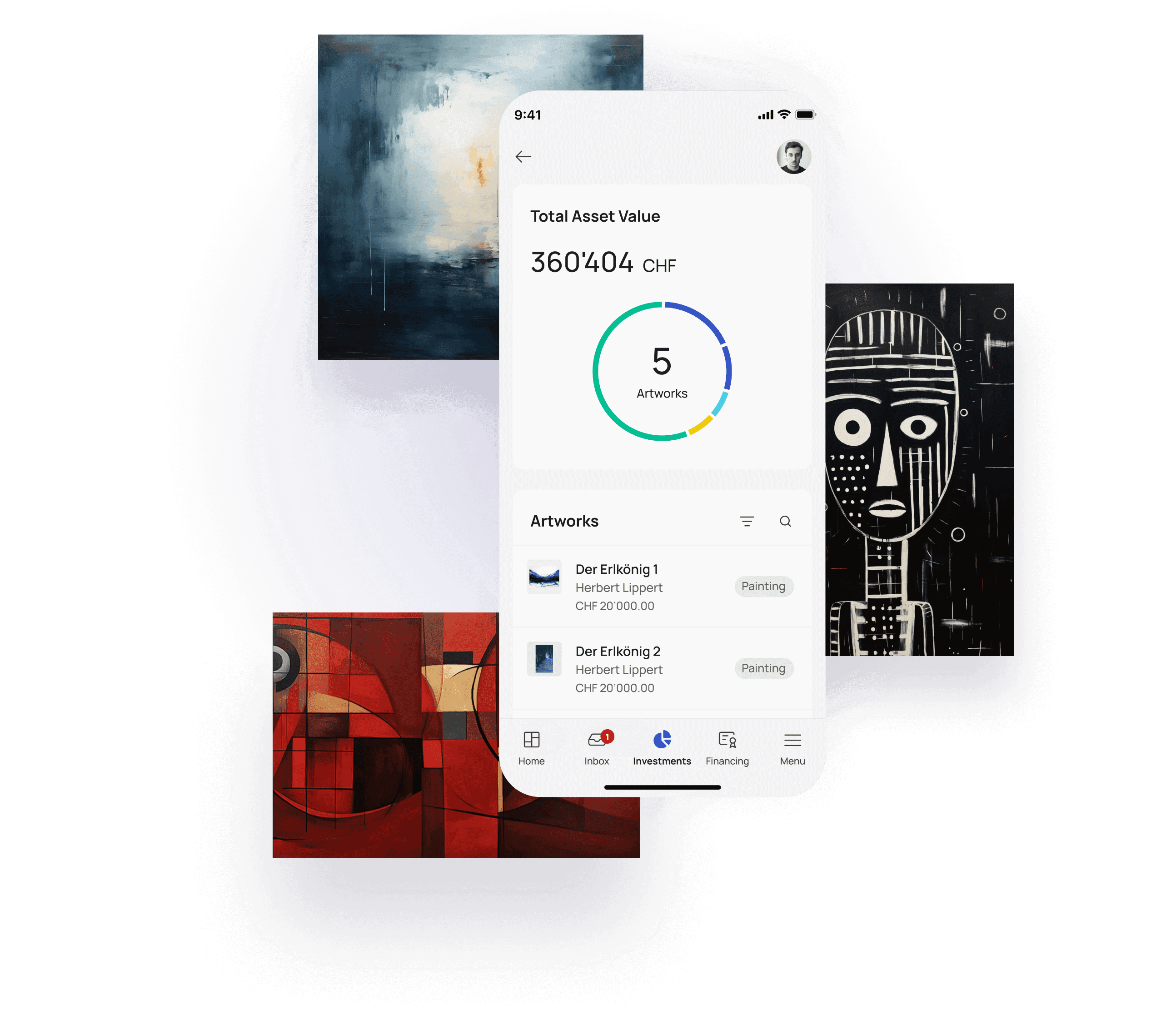

Art Tokenisation

Turning artworks into liquid and cash generating assets

Your Challenges

Liquidity needs of artworks owners

Limited access to blue chip art market

No cash income from artworks investments

Limited and expensive artworks lending

Our Solutions

Fractional ownership to meet the liquidity needs

Easier access to blue chip artworks by co-ownership

Income from artwork as a collateral

Renting of Physical Artworks

Your Benefits

Addressing the liquidity needs of artwork owners by enabling partial sales and reducing reliance on high-commission sales or costly lending options. It democratises access to the blue-chip art market, allowing smaller investors to diversify their portfolios with high-value artworks. By facilitating the rental of physical artworks and their use as collateral, the platform can generate income for co-owners. Utilising Swiss Property law and a tokenisation platform, it ensures secure co-ownership and efficient governance. Additionally, the platform can build a robust network of curators, brokers, and asset managers, and provides a secondary market for trading shares and a club for art enthusiasts.